MINTO – Town officials are proposing a 2025 budget that projects a 6.5 per cent tax levy increase.

Last year the town approved a 4.39% levy increase.

If the 6.5% increase is approved, a property with an average assessment of $250,000 would pay an additional $25 in town taxes next year, Minto treasurer Gordon Duff told the Advertiser.

At the Nov. 5 council budget meeting, officials reviewed the operating portion of the budget, with staff presenting an estimate of requested funding.

The capital budget was not discussed, as the town has scheduled two separate dates each to discuss the operating and capital budgets.

Staff plan to take council’s feedback and amendments from the Nov. 5 meeting and return on Nov. 26 to present the capital budget.

The town plans to host an open house on Dec. 3 from 5 to 6pm for the “public to ask questions and participate.”

Operating expenses

Minto’s draft operating budget is $6.8 million, with $761,500 going into reserves.

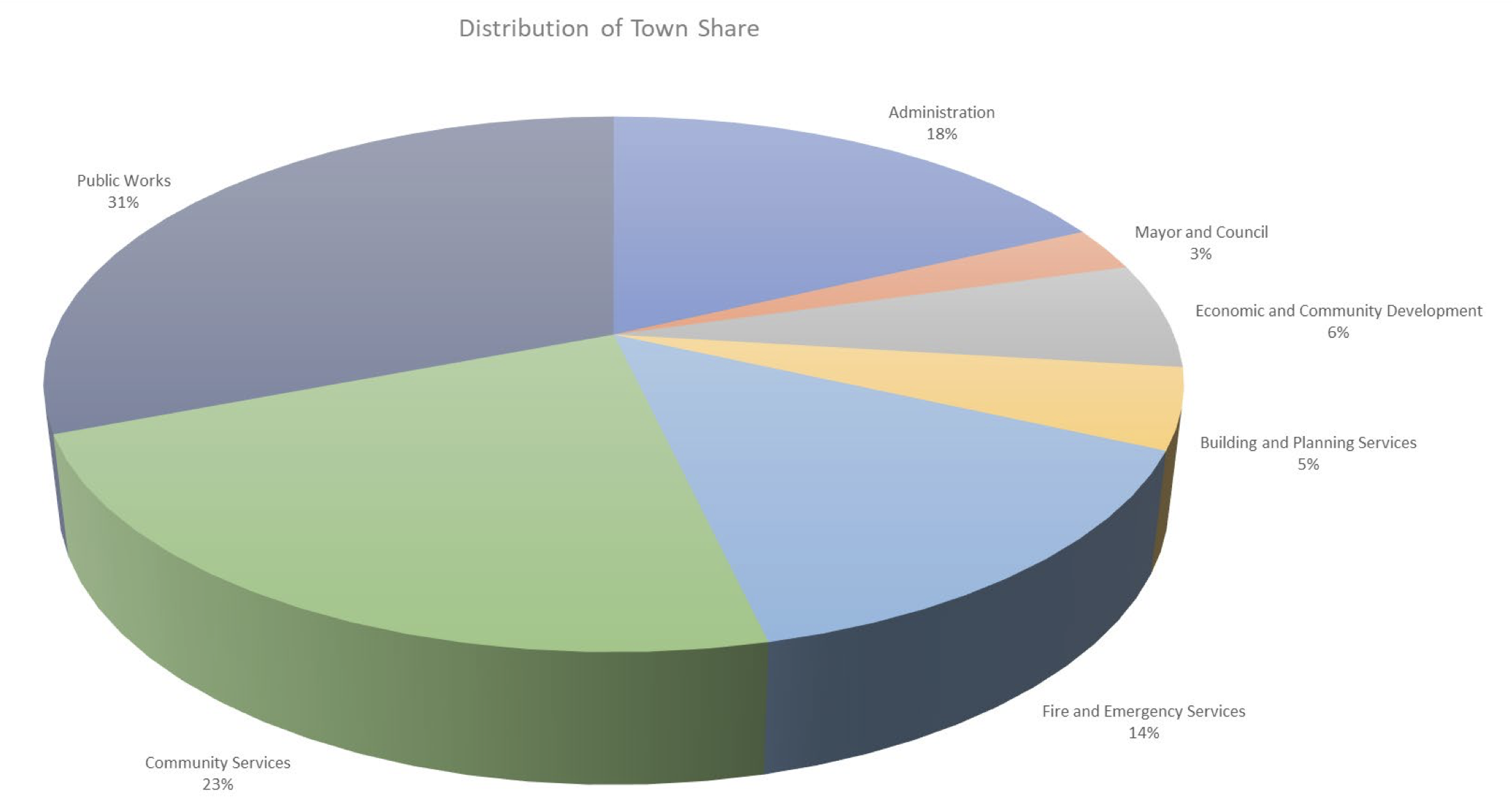

By department, the draft sets aside $2.6 million for public works, $1.9 million for community services, $1.8 million for administration, $1.1 million for fire and emergency services, and $515,000 for economic development.

The largest expenses in the draft operating budget include:

- $1.1 million for road administration;

- $927,000 for roads and sidewalk maintenance;

- $728,000 for the CAO and clerk’s office;

- $704,000 for recreation facilities; and

- $600,000 for community services administration.

Deputy mayor Jean Anderson brought up the “ongoing crisis” in the health care industry, with people showing up to hospital emergency departments because they have “nowhere else to get health care.”

She suggested increasing the health and services budget because 2025 proposed spending ($43,000) is lower than the 2024 amount.

“That’s a provincial responsibility, but it’s the only way you can maintain any kind of hope of having a health care system where people have access to a health care provider within a reasonable time frame,” Anderson said.

She suggested the creation of community clinics supported by the municipality.

This image shows the distribution of Minto taxes. Minto budget agenda image

Mayor Dave Turton asked how wages for Minto volunteer firefighters compared to other municipalities.

Director of fire services Chris Harrow explained the town has been on the lower side in the past, but over the years the wages have increased.

“I’m not going to lie, we’re probably going to have to go up a little bit just to stay in the market that other ones (municipalities) are paying,” said Harrow.

Next steps

As for the upcoming capital budget, Duff stated it “will likely not have any effect on the [6.5% increase] because we’re rolling all capital expenditures through reserve funds.”

He added, “We’re going to be bringing a lot of options to you that would increase transfers to reserves from the operating budget.”

Duff explained budget estimates discussed may change as the town still has six outstanding grant applications.

For all taxes collected, 37.3% is the town’s share, 15.4% goes towards education and 47.3% to the County of Wellington.

Town council is aiming to approve the final 2025 budget in December.