MAPLETON – Property owners here may face a tax levy increase of 3.55 per cent in 2025.

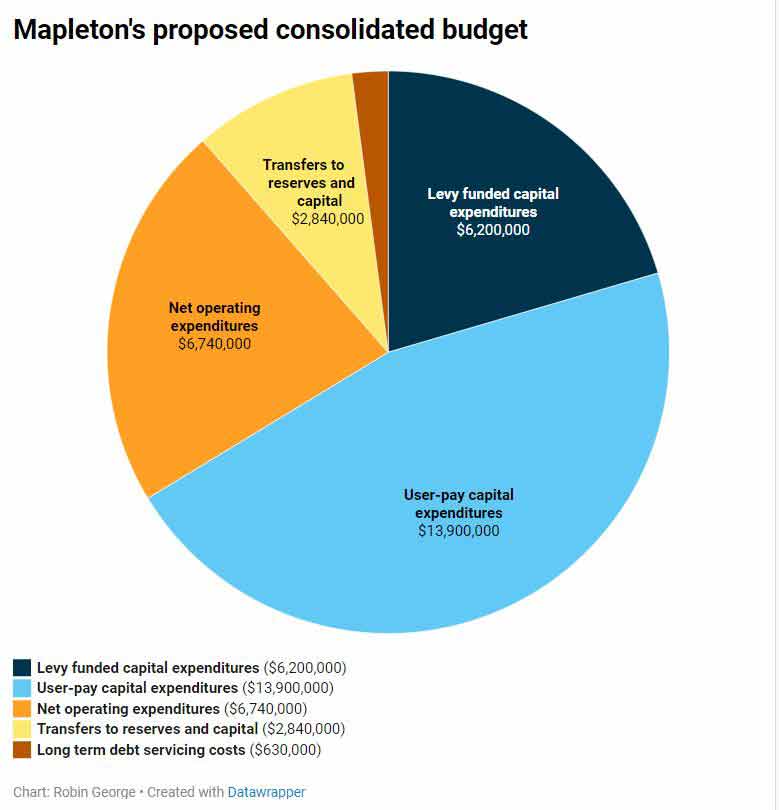

Mapleton’s proposed 2025 consolidated budget tops $30 million, with over $20 million in total capital expenditures, $6.7 million in operating expenditures, a $2.8 million transfer to reserves and capital, and more than $600,000 in long-term debt servicing costs.

The general levy requirement is $10.2 million – a combination of the operating expenditures, transfer to reserves and capital, and long-term debt servicing.

The capital expenditures will be covered by external grant funding, development charges, reserve funds, debentures and community donations, chief financial officer Patrick Kelly told the Community News.

This includes $6 million in levy-funded capital costs and $14 million in user-pay capital costs, he states.

Key budget pressures include inflation, lean staffing, external government funding, service level expectations and capital funding increases.

The proposed budget was tabled during a regular meeting of council on Oct. 22.

The presentation was not intended for questions, debate or deliberations, Kelly noted during the meeting; it was just a chance to present the budget to council and the community.

On Nov. 18, staff will hold a public input session at the PMD Arena.

On Dec. 10, the budget is set to be presented for consideration and approval.

Tax levy

The proposed budget’s levy requirement of $10.2 million represents an increase of $350,341, or 3.55%, from the 2024 net levy requirement of $9.9 million.

“The residential tax rate cannot be determined until the township receives the updated assessment role for 2025 taxes,” Kelly told the Community News.

“Assuming no change in the distribution of assessment values between property classes, or the tax ratios established by the county, the average tax payer would see an increase of $65.63 in the Mapleton proportion of their tax bill.”

This does not include the portion of tax bills that go to Wellington County (49% of the bill) or school boards (15%).

In order to limit the 2025 increase, staff have deferred “a number of additional service level changes (staffing),” deferred or re-prioritized capital initiatives and deferred potential service level enhancements, the budget report states.

The proposed increase “will enable the township to recalibrate some previous budget allocations and avoid a reliance on non-sustainable revenue stresses, such as the rate stabilization reserve funds, or higher than anticipated operating revenues (fees and charges),” the report states.

Breakdown – Mapleton’s proposed budged includes over $20 million in total capital expenditures, $6.7 million in net operating expenditures, a $2.8-million transfer to reserves and capital and more than $600,000 in long-term debt servicing costs. Datawrapper chart by Robin George

Expenditures

According to Mayor Gregg Davidson, “This budget attempts to strike a balance between being fiscally responsible to you, our residents and businesses, while investing in our community’s infrastructure and community services.”

Big ticket capital expenditures include:

– wastewater treatment capacity increases, set to cost $18.5 million over three years (about $6 million in 2025);

– Drayton wastewater pumping station upgrades and force main twinning, set to cost almost $13 million over three years (about $4.3 million in 2025);

– Moorefield water system renewal, set to cost about $6.3 million over two years (about $3.2 million in 2025); and

– Sideroad 6 bridge/culvert replacement, set to cost about $1.3 million in 2025.

Operating expenditures, include over $2 million for core infrastructure, $1 million for roads, $840,000 for fire services and emergency management, $424,000 for administration $394,000 for recreation and programs, and $316,000 for council.

CAO Manny Baron said the budget is more than a financial plan as it provides “a blue print for our community’s priorities and aspirations. It reflects our values and our dedication to providing essential services, fostering growth and enhancing the quality of life for all our residents.”

He asked that while reviewing the report, people “consider not just the numbers, but the lasting impact our decisions will have on current and future generations.”

Kelly said seven core guiding principals were followed during the budget’s creation: openness and transparency, public engagement, fiscal responsibility, inflationary pressures, property tax versus rate-based, growth pays for growth and modernization/efficiency.

Inflation

“Inflation is still present,” Kelly said during the meeting. “It is decelerating – it was at 2.4% when we developed the budget projections.”

“While the impacts of the global pandemic are becoming less impactful on municipal operations, numerous conflicts throughout the world continue to weigh heavily on markets and confidence,” the report states. “The continuing battles in Israel and Ukraine are increasing risk in the economy, bringing instability to commodity prices and supply chain disruptions.”

“Multi-year forecasts project annual [inflation] impacts of 3% to 5% of most municipal operating costs,” according to the report.

“Base costs impacted by inflationary pressures include compensation, contractual commitments, insurance, utilities, facility repairs and fleet maintenance,” Kelly noted.

“On top of these everyday operational costs are debt servicing obligations to fund critical infrastructure investments,” he stated.

“As infrastructure ages, adequate funds must be committed for proper maintenance, repair and replacements.”

And the most reliable way to fund maintaining and replacing infrastructure is transferring tax levy funds to infrastructure reserve funds, Kelly stated.

Funding

“Mapleton receives only 3.9% of yearly revenues from provincial or federal sources,” Davidson notes in the report.

“The rest comes from our residential, commercial and industrial tax base.”

He outlined three main ways to raise revenues: user fees, development charges and property taxation.

“Growth in our community has slowed in recent years, which puts additional pressure on the existing tax base,” Baron noted. “Over the past decade, the average property taxes [in Mapleton] have increased at an annualized rate of only 1.19%, well below inflation levels.

“Setting the tax levy increase lower than the rate of inflation has created a cumulative funding gap and increased expectations on our relatively small workforce,” Baron stated.

“We are working to close existing funding gaps and ensure appropriate staffing levels by eliminating reliance on non-sustainable revenue streams, diversifying revenues outside of the tax base, vigilant asset management and cost containment through process efficiencies.”