BRUCEDALE – Guelph/Eramosa council has approved the township’s 2025 budget with a tax rate increase of 3.79 per cent.

Councillor Mark Bouwmeester voted against the motion to adopt the budget on Jan. 13, saying the “levy increase is too high,” but otherwise there was little comment from council on the matter.

The township’s total budget is $23,940,281, with $9,156,679 to be funded through taxation.

Mayor Chris White confirmed nothing had been changed in the budget since a meeting on Dec. 11 to present updated numbers and gather public feedback.

At that time there had been a few minor changes to what was previously presented to council on Nov. 18.

White said the changes included lower-than-forecasted insurance costs, and a change in WSIB (Workplace Safety and Insurance Board) rates.

The estimates for revenue from parks and recreation programs were also revised to show higher revenue than originally forecasted.

Original proposal was 4.38%

The combined changes moved the tax rate increase from the 4.38% originally proposed in November to the 3.79% council passed this week.

The Jan. 13 meeting agenda did not include a report on the budget, just a bylaw listing the “current estimates for 2025” in two categories: “Revenues” and “Expenditures.”

The largest item under the expenditures column is transportation at $8,485,414.

There is also a “transportation infrastructure levy” of $431,000 listed.

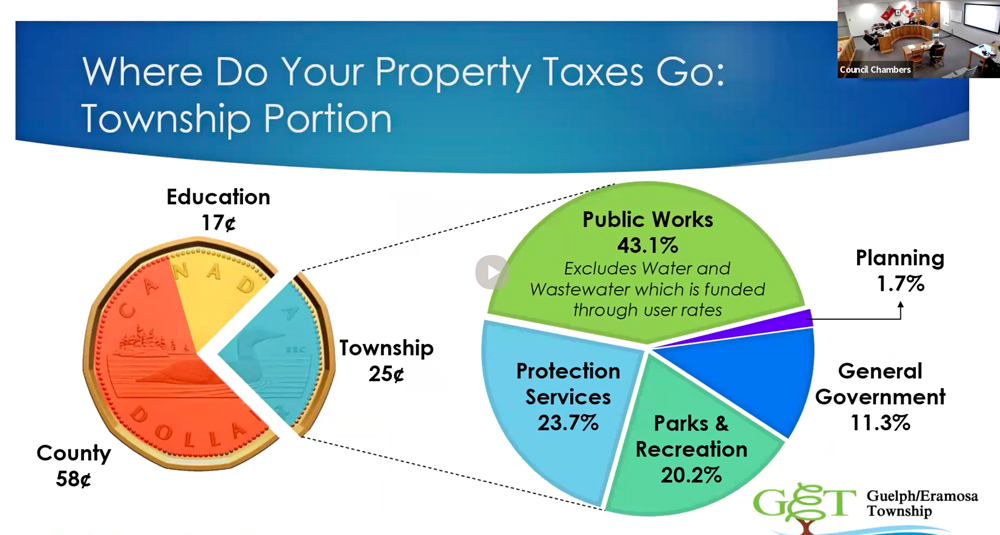

This graph from Guelph/Eramosa treasurer Linda Cheyne’s Dec. 11 budget presentation shows how much of residents’ taxes go to the township, and which departments get the greatest portion of that money.

Public works takes lion’s share of budget

In her Dec. 11 presentation to council treasurer Linda Cheyne pointed out the public works department – excluding water and wastewater, which are funded through user fees – takes the greatest share of the township portion of property taxes at 43.1%.

Protection services, such as fire and bylaw, take 23.7%, and parks and recreation takes 20.2%. Planning and general government combined make up the remaining 13%.

The 2024 taxation levy was $8,734,499, and there was an additional $90,838 in assessment growth.

The proposed taxation requirement for 2025 was $8,725,679, plus the $431,000 infrastructure levy to bring the total to $9,156,679.

Factoring in the assessment growth, it’s an increase of $331,342 over last year, and an impact of 3.79% to current taxpayers.

Cheyne said previously that amounts to an increase to the tax bill of $11.27 for every $100,000 of residential assessed value.

Multiple residents spoke at the Dec. 11 meeting to ask council to push for a lower tax rate, taking issue with discretionary spending on capital projects ranging from park upgrades to speed humps.

But ultimately no changes were made following that meeting.