BRUCEDALE – Guelph/Eramosa is looking at a four per cent tax rate increase based on the proposed 2025 budget presented to council at its Nov. 18 committee of the whole meeting.

“Our total budget this year is $23.5 million,” director of finance Linda Cheyne told council.

Cheyne provided a brief overview of the budget numbers before turning the floor over to staff from various departments, who presented a range of capital projects proposed for 2025.

Cheyne broke down the total proposed spending for 2025, saying $5.9 million of the $23.5 million would go to water and wastewater-related expenses, which are not funded through taxation; $9.9 million would cover operating expenses; $4.7 million would be spent on capital assets; $2.8 million would be transferred to reserves; and $200,000 would go toward long-term debt repayment.

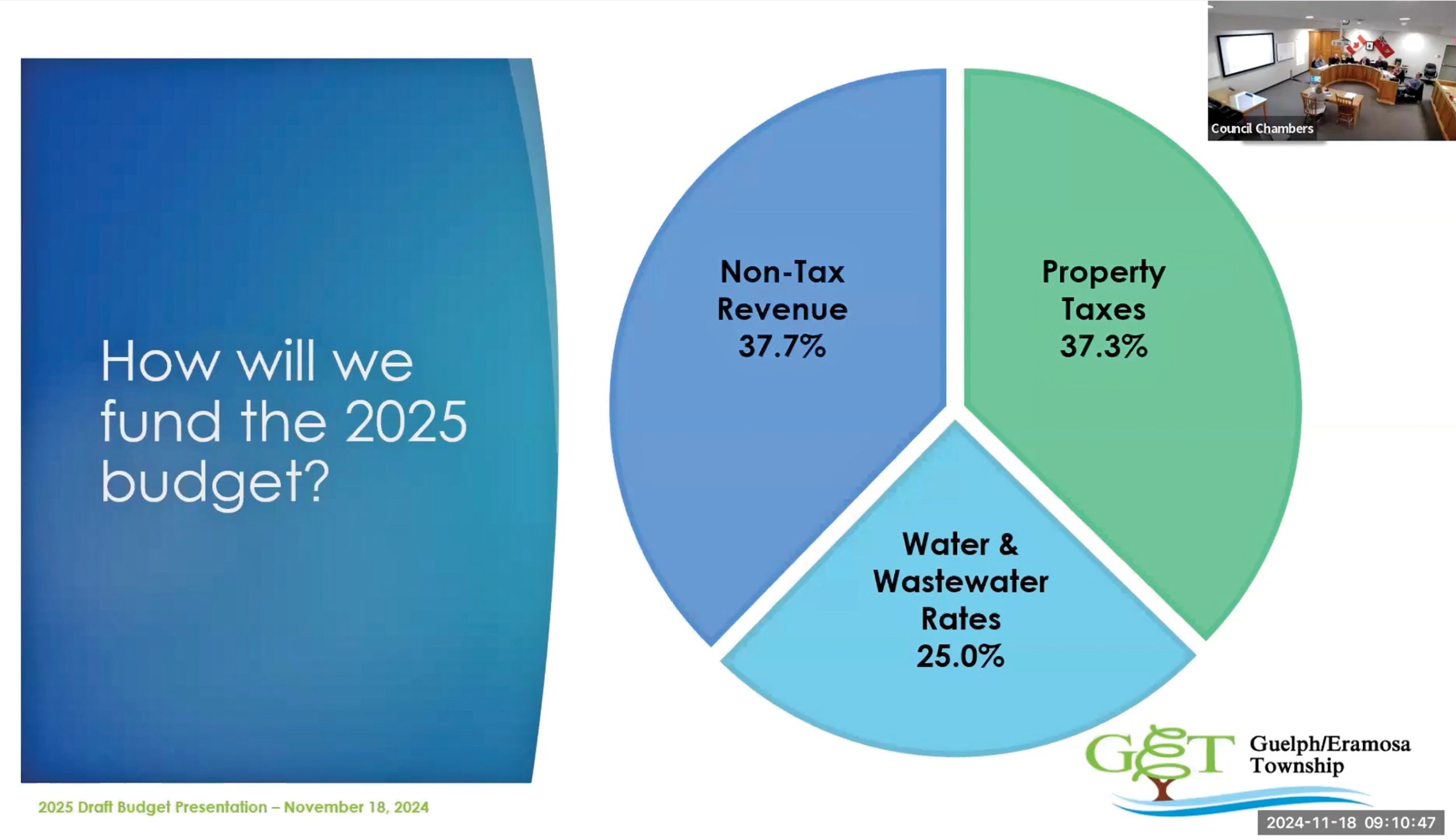

Revenue sources include $5.9 million in user fees and development charges for water and wastewater; $8.8 million in non-tax revenue in the form of user fees, grants, development charges and reserves; and $8.8 million in property taxes, Cheyne said.

Property taxes will fund 37% of the budget, she added.

She noted the township has $171 million invested in municipal assets.

“We’re committed to sustaining these assets going forward,” she said, explaining an addition $190,000 is included in the proposed operating budget to transfer to reserves to fund things like bridge, equipment and the like.

“And we’ve proposed to collect a separate levy – an infrastructure renewal levy – of $431,000, which is an increase of $101,000 over last year,” Cheyne said.

This screenshot from the recording of Guelph/Eramosa’s Nov. 18 committee of the whole meeting shows the percentage of the proposed 2025 budget that would come from taxes.

The total proposed capital spending is $6.8 million, which includes $2.15 million on water and wastewater, she said.

Council then heard more than two hours of “capital highlights” presentations from township staff across all departments.

Capital expenses include:

- $104,500 for IT upgrades to move from a physical server to a cloud-based application;

- $740,000 to resurface a 2.36km stretch of 8th Line;

- $1.4 million to replace two bridges on 7th Line;

- $110,000 to replace a front-end loader for the parks and recreation department;

- $250,000 to install six beach volleyball courts at Marden Park;

- $80,000 to replace the fire department’s auto-extraction equipment; and

- $50,000 for three gateway signs for Rockwood.

Council questioned staff about the proposed projects, looking to get a better understanding of them.

Cheyne then returned to the table to provide a summary of how the proposed budget would impact tax payers.

“In 2024, we had a general tax levy of $8.4 million,” she said, noting a separate levy of $330,000 was collected for infrastructure, bringing the total 2024 tax levy to $8.73 million.

New tax revenue in the form of assessment growth amounts to $90,838.

“The budget you have seen today has a general tax requirement of $8.7 million,” Cheyne said.

Adding the proposed infrastructure levy of $431,000, the total tax requirement is $9.2 million.

It amounts to an additional $382,442, which represents a 4.4% increase, said Cheyne.

That increase represents $13.02 for each $100,000 worth of assessment, she said.

“On a home valued at half a million dollars, it would be an increase of $65.10,” she said.

Cheyne noted the numbers may change slightly when final assessment numbers come in early December.

“With the information that we have right now, this is where we are,” she said.

Mayor Chris White said he hoped the tax rate increase could come down slightly before the budget gets approved.

“If there was a way for this thing to get down below four, that would make me very happy,” White said.

Cheyne responded by saying staff have been “fairly aggressive” this year on the proposed increase to reserves.

“You’re doing all the right things,” said White, noting there is a need to deal with an infrastructure deficit.

“This is a little bit above inflation as it currently sits, so something below four (%) might be more comfortable.”

The township’s next budget meeting will be a special meeting of council on Dec. 11 at 1pm.

This will be an opportunity for members of the public to provide input on the proposed budget.

Directions will be provided during the meeting for members of the public who wish to speak or make comments.

To pre-register as a delegate, email clerks@get.on.ca.