ERIN – Council here passed a bylaw on May 11 establishing Sept. 29 and Nov. 30 as instalment dates for all tax classes in Erin.

Last December, council endorsed a 2.5 per cent rate increase to the levy, used to pay for town operations and infrastructure.

Although the budgeted increase was 2.5%, town finance director Wendy Parr told council this month the rate increase is “lower than the budgeted tax levy increase” because of higher property values and overall assessment growth last year.

Parr said the year-over-year increase is actually closer to around 1.48%.

But that doesn’t factor in the Wellington County or educations boards’ budgets.

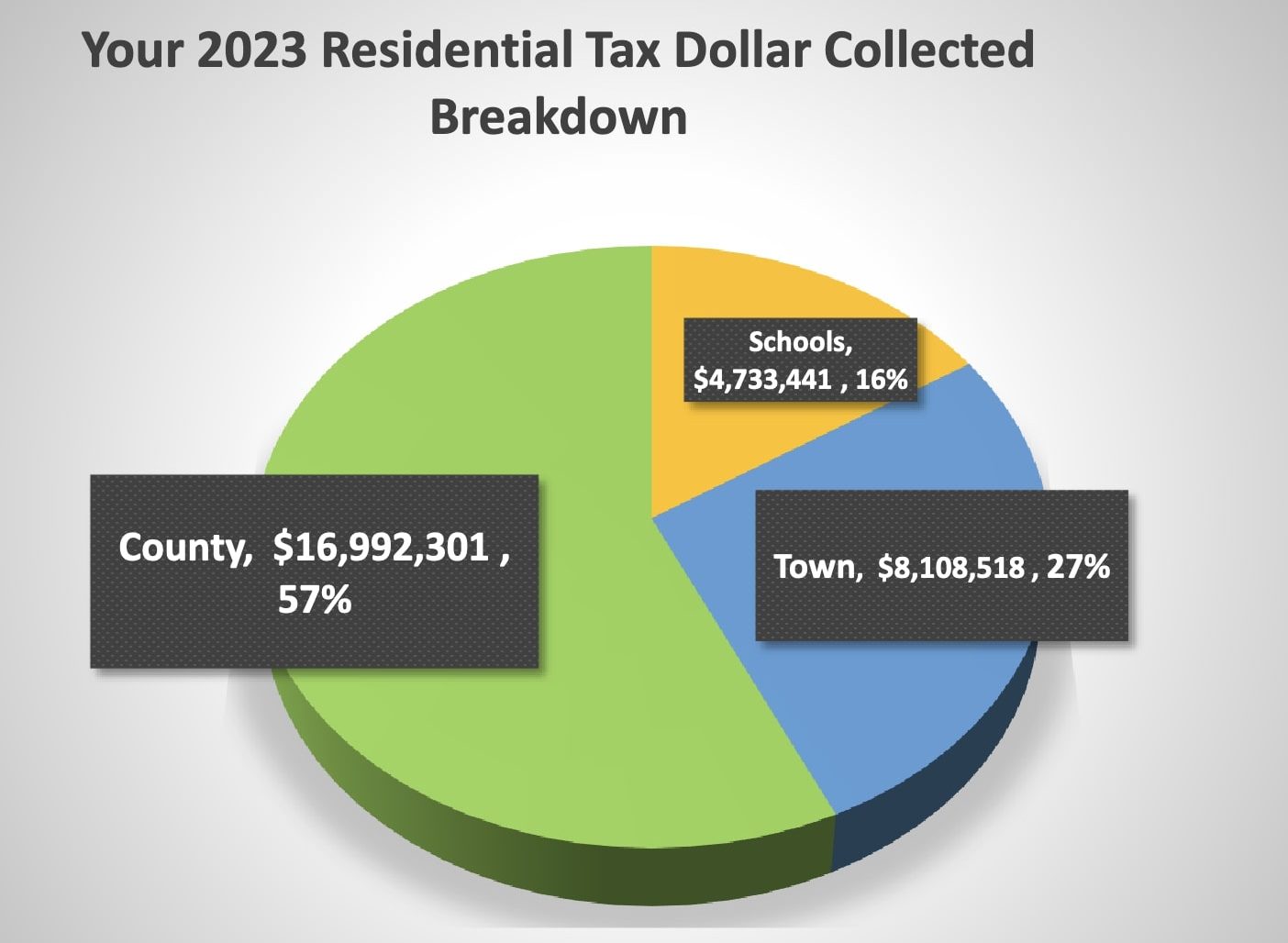

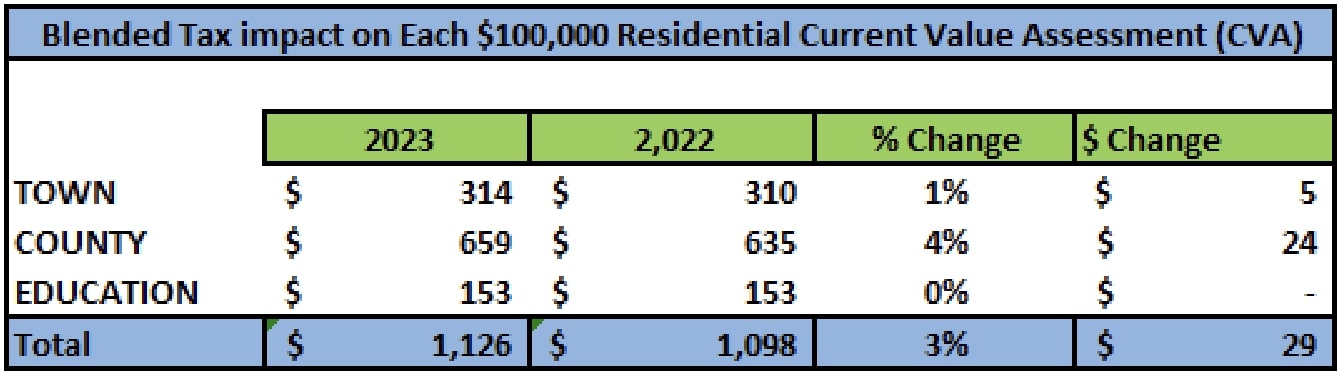

The blended rate – including the county’s 57 cents on each dollar, and education’s 16 cents – means a 2.63% increase year-over-year. Practically, that means a taxpayer with a home valued at $600,000, based on current value assessment, will be taxed around $6,756 this year.

That’s an increase of $174 from 2022. Considering only that increased portion, $30 goes to the town and $144 goes to the county.

Town of Erin graphic

Looking at the overall tax bill, including this year’s increase, the town will keep around $1,884.

For each tax dollar collected, the town keeps 27 cents and the rest goes to the county and education boards.

Of town’s share, 13 cents goes to roads; eight cents to planning, economic development and corporate services; three cents to parks/recreation and conservation authorities, and three cents to fire services.

Erin taxpayers will be contributing to a total 2023 levy of $29.83 million.

The town’s levy is $8.1 million ($7.25 million for operations and $857,865 for infrastructure), the county-wide levy is $16.99 million, and the education boards’ levy is $4.73 million.

Around 1,936 Erin tax bills will also include a per-unit charge of $61.44 to pay for streetlights.